Ten years ago this week I thought I would write a piece to offer a useful metaphor for straight white male privilege without using the word “privilege,” because when you use the word “privilege,” straight white men freak out, like, I said then, “vampires being fed a garlic tart.” Since I play video games, I wrote the piece using them as a metaphor. And thus “Straight White Male: The Lowest Difficulty Setting There Is” was born and posted.

And blew up: First here on Whatever, where it became the most-visited single post in the history of the site (more than 1.2 million visits to date), and then when it was posted on video gaming site Kotaku, where I suspect it was visited a multiple number of times more than it was visited here, because Kotaku has more visitors generally, and because the piece was heavily promoted and linked there.

The piece received both praise and condemnation, in what felt like almost equal amounts (it wasn’t; it’s just the complainers were very loud, as they often are). To this day the piece is still referred and linked to, taught in schools and universities, and “living on the lowest difficulty setting” is used as a shorthand for the straight white male experience, including by people who don’t know where the phrase had come from.

(I will note here, as I often do when discussing this piece, that my own use of the metaphor was an expansion on a similar metaphor that writer Luke McKinney used in a piece on Cracked.com, when he noted that “straight male” was the lowest difficulty setting in sexuality. Always credit sources and inspirations, folks!)

In the ten years since I’ve written the piece, I’ve had a lot of time to think about it, the response to it, and whether the metaphor still applies. And so for this anniversary, here are some further thoughts on the matter.

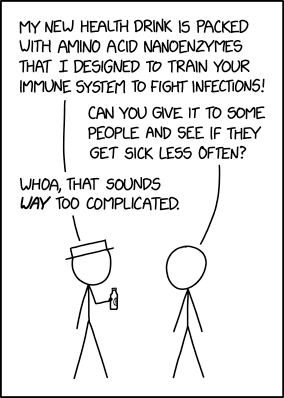

1. First off: Was the piece successful? In retrospect, I think it largely was. One measure of its success, as noted above, is its persistence; it’s still read and talked about and taught and used. Anecdotally, I have hundreds of emails from people who used it to explain privilege to others and/or had it used to explain privilege to them, and who say that it did what it was meant to do: Get through the already-erected defenses against the word “privilege” and convey the concept in an interesting and novel manner. So: Hooray for that. It is always good to be useful.

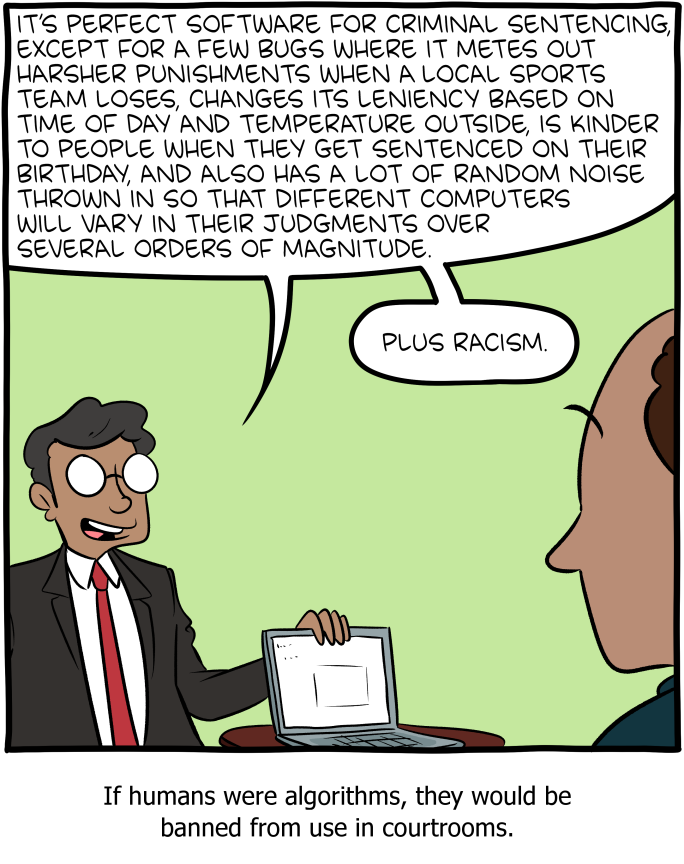

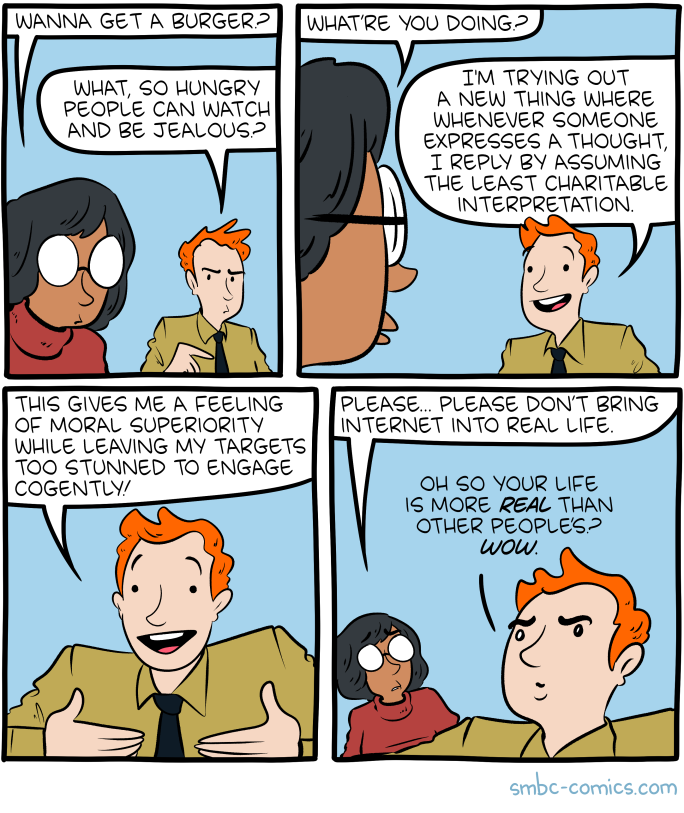

2. That said, Upton Sinclair once wrote that “It is difficult to get a man to understand something when his salary depends upon his not understanding it.” In almost exactly the same manner, it is difficult to get a straight white man to acknowledge his privileges when his self-image depends on him not doing so. Which is to say there is a very large number of straight white men who absolutely do not wish to acknowledge just how thoroughly and deeply their privileges are systemically embedded into day-to-day life. A fair number of this sort of dude read the piece (or more perhaps more accurately, read the headline, since a lot of their specific complaints about the piece were in fact addressed in the piece itself) and refused to entertain the notion there might be something to it. Which is their privilege (heh), but doesn’t make them right.

But, I mean, as a straight white dude, I totally get it! I also work hard and make an effort to get by, and in my life not all the breaks have gone my way. I too have suffered disappointment and failure and exclusion and difficulty. In the context of a life where people who are not straight white men are perhaps not in your day-to-day world view, except as abstractions mediated by television or radio or web sites, one’s own struggles loom large. It’s harder to conceive of, or sympathize with, the idea that one’s own struggles and disappointments are resting atop of a pile of systemic privilege — not in the least because that implicitly seems to suggest that if you can still have troubles even with those many systemic advantages, you might be bad at this game called life.

But here’s the thing about that. One, just because you can’t or won’t see the systemic advantages you have, it doesn’t mean you don’t still have them, relative to others. Two, it’s a reflection of how immensely fucked up the system is that even with all those systemic advantages, lots of straight white men feel like they’re just treading water. Yes! It’s not just you! This game of life is difficult! Like Elden Ring with a laggy wireless mouse and a five-year-old graphics card! And yet, you are indeed still playing life on the lowest difficulty setting!

Maybe rather than refusing to accept that other people are playing on higher difficulty settings, one should ask who the hell decided to make the game so difficult for everyone right out of the box (hint: they’re largely in the same demographic as straight white men), and how that might be changed. But of course it’s simply just easy to deny that anyone else might have a more challenging life experience than you have, systemically speaking.

3. Speaking of “easy,” one of the problems that the piece had is that when I wrote the phrase “lowest difficulty,” lots of people translated that to “easy.” The two concepts are not the same, and the difference between the two is real and significant. Which is, mind you, why I used the phrase “lowest difficulty” and not “easy.” But if you intentionally or unintentionally equate the two, then clearly there’s an issue to be had with the piece. I do suspect a number of dudes intentionally equated the two, even when it was made clear (by me, and others) they were not the same. I can’t do much for those dudes, then or now.

4. When I wrote the piece, some folks chimed in to say that other factors deserved to be part of a “lowest difficulty setting,” with “wealth” being primary among them. At the time I said I didn’t think wealth should have been; it’s a stat in my formulation — hugely influential, but not an inherent feature of identity like being white, or straight, or male. This got a lot of pushback, in no small part because (and relating to point two above) I think a lot of straight white dudes believed that if wealth was in there, it would somehow swamp the privileges that being white and straight and male provide, and that would mean that everyone else’s difficulty setting was no more difficult than their own.

It’s ten years on now, and I continue to call bullshit on this. I’ve been rich and I’ve been poor and I’ve been in the middle, and in all of those economic states I still had and have systemic advantages that came with being white and straight and male. Yes, being wealthy does make life less difficult! But on the other hand being wealthy (and an Oscar winner) didn’t keep Forest Whitaker from being frisked in a bodega for alleged shoplifting, whereas I have never once been asked to empty my pockets at a store, even when (as a kid, and poor as hell) I was actually shoplifting. This is an anecdotal observation! Also, systemically, wealth insulates people who are not straight and white and male less than it does those who are. Which means, to me, I put it in the right place in my formulation.

5. What would I add into the inherent formulation ten years on? I would add “cis” to “straight” and “white” and “male.” One, because I understand the concept better than than I did in 2012 and how it works within the matrix of privilege, and two, in the last decade, more of the people I know and like and love have come out as being outside of standard-issue cis-ness (or were already outside of it when I met them during this period), and I’ve seen directly how the world works on and with them.

So, yes: Were I writing that piece for the first time in 2022, I would have written “Cis Straight White Male: The Lowest Difficulty Setting There Is.”

6. Ten years of time has not mitigated the observation about who is on the Lowest Difficulty Setting, especially here in the United States. Indeed, if anything, 2022 in the US has been about (mostly) straight white men nerfing the fuck out of everyone else in the land in order to maintain their own systemic advantages. Oh, you’re not white? Let’s pass laws to make sure an accurate picture of your historical treatment is punted out of schools and libraries, and the excuse we’ll give is that learning these things would be mean to white kids. You’re LGBTQ+? Let’s pass laws so that a teacher even mentioning you exist could get them fired. Trans? Let’s take away your rights for gender-affirming medical treatment. Have functional ovaries? We’re planning to let your rapist have more say in what happens to your body than you! Have a blessed day!

And of course hashtag not all straight white men, but on the other hand let’s not pretend we don’t know who is largely responsible for this bullshit. The Republican party of the United States is overwhelmingly straight, overwhelmingly white, and substantially male, and here in 2022 it is also an unabashedly white supremacist political party, an authoritarian party and a patriarchal party: mainstream GOP politicians talk openly about the unspeakably racist and anti-Semitic “Great Replacement Theory,” and about sending people who have abortions to prison, and are actively making it more difficult for minorities to vote. It’s largely assumed that once the conservative supermajority of the Supreme Court (very likely as of this writing) throws out Roe v. Wade, it’ll go after Obergefell (same-sex marriage) as soon as a challenge gets to them, and then possibly Griswold (contraception) and Loving (mixed-race marriage) after that. Because, after all, why stop at Roe when you can roll civil rights back to the 1950s at least?

What makes this especially and terribly ironic is that when game designers nerf characters, they’re usually doing it to bring balance to the game — to put all the characters on something closer to an even playing field. What’s happening here in 2022 isn’t about evening up the playing field. It’s to keep the playing field as uneven as possible, for as long as possible, for the benefit of a particular group of people who already has most of the advantages. 2022 is straight white men employing code injection to change the rules of the game, while it’s in process, to make it more difficult for everyone else.

So yes, ten years on, the Lowest Difficulty Setting still applies. It’s as relevant as ever. And I’m sure, even now, a bunch of straight white men will still maintain it’s still not accurate. As they would have been in 2012, they’re entirely wrong about that.

And what a privilege that is: To be completely wrong, and yet suffer no consequences for it.

— JS